Bridging Giants: Navigating the US-China Supply Chain in a Shifting Global Landscape

Unlocking Opportunities Amidst Geopolitical Change

Unknow author

05 June 2025, 0 min read

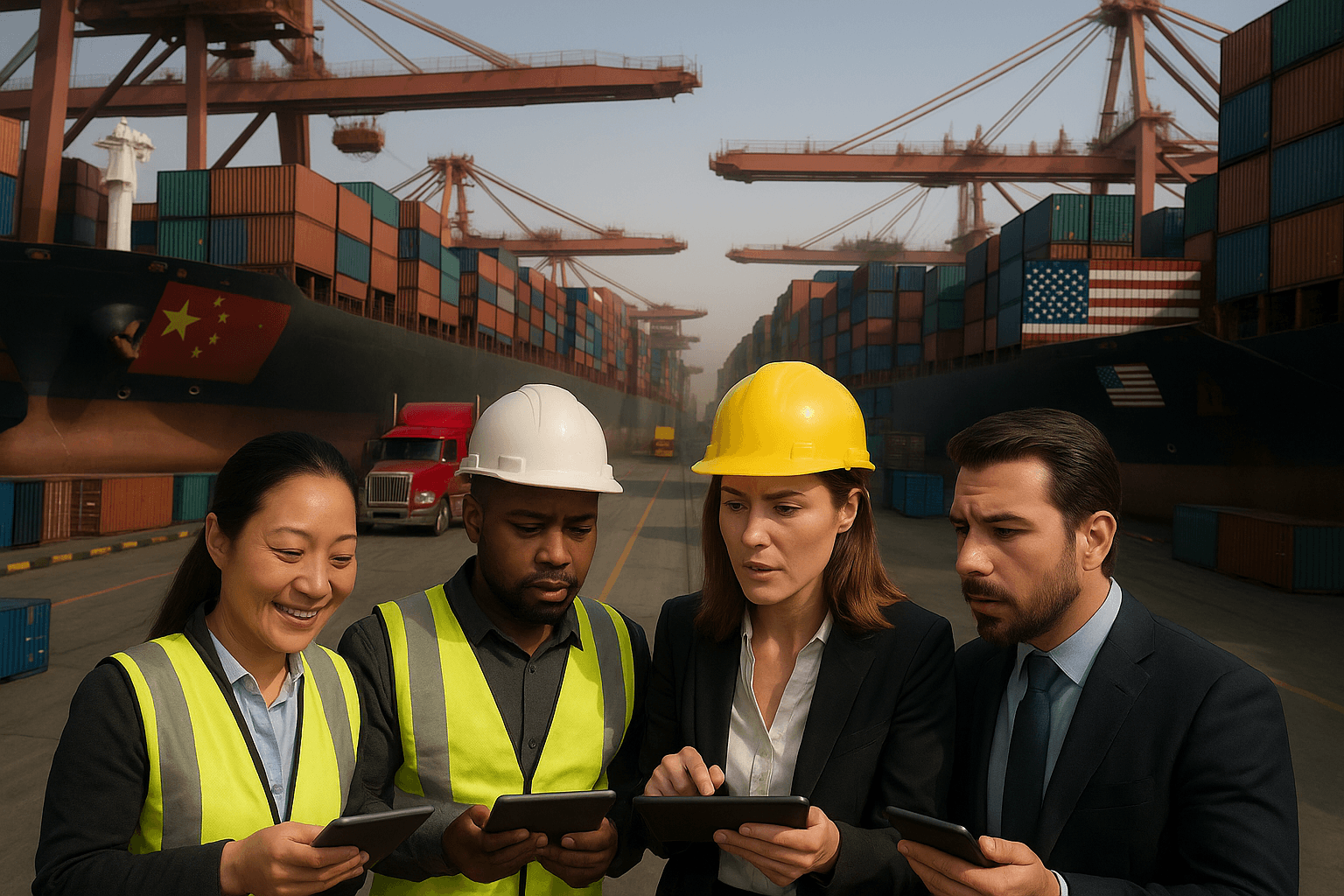

The US-China trade corridor remains the linchpin of global commerce, with bilateral trade reaching $582.4 billion in goods in 2024, underscoring its role as the world’s most consequential economic relationship. Despite geopolitical tensions, COVID disruptions, and tariff-induced realignments, this supply chain continues to underpin industries ranging from electronics to automotive manufacturing. According to U.S. statistics, in 2024, China accounted for 13.4% of total U.S. imports, while the U.S. remained a critical market for Chinese exports, including consumer electronics and industrial machinery.

This article examines how the US-China supply chain adapts to a shifting global landscape, balancing economic interdependence with geopolitical risk. By analyzing trade data, sectoral vulnerabilities, and emerging strategies, it explores pathways for resilience in a corridor that remains irreplaceable to global commerce.

The Backbone of Global Trade

The scale of interdependence between the U.S. and China is staggering: ports like Shanghai and Los Angeles handle millions of containers annually, with cargo volumes reflecting the corridor’s resilience amid turbulence and it spans lots of critical sectors:

- Electronics: China’s dominance in manufacturing components like semiconductors and batteries remains unmatched, exports of 3D printers industrial robots surging 32.8% and 45.2% in 2024

- Automotive: Chinese exports of car parts to Mexico have doubled in five years, feeding North American assembly lines.

- Renewables: Solar panels and lithium batteries rely on Chinese raw materials and processing, China produces over 69% of global rare earth minerals.

Yet, this reliance creates vulnerabilities. The COVID pandemic exposed supply chain fragility, while the US-China tariff war (2018–present) has reshaped trade flows. For example, solar panels rerouted through Vietnam and Malaysia to bypass US restrictions highlight the corridor’s complexity.

Complexity & Challenges in the Corridor

The post-pandemic recovery and escalating U.S.-China trade war has triggered cascading disruptions and strategic shifts in the U.S.-China supply chain

- Geopolitical Pressures: In 2025, the U.S. imposed 20% tariffs on Chinese imports, targeting electronics, automotive components, and machinery. China retaliated with 10–15% tariffs on U.S. agricultural goods, liquefied natural gas, coal, and rare earth metals.

- Operational Risks: U.S. importers face extended lead times and inventory volatility, as companies preemptively stockpile goods to hedge against tariff uncertainty. Also, 2025’s tariff measures mentioned above have accelerated port congestion as exporters rush shipments ahead of tariff deadlines, while labor shortages and rising freight costs compound operational risks.

- Diversification Trends: While nearshoring to Mexico and Southeast Asia gains traction, China retains dominance in metals production and electronics manufacturing ecosystems. Companies like Apple have diversified suppliers to Vietnam and India, yet indirect reliance on Chinese components persists–even in Mexican exports to the U.S.

While companies seek alternatives,indirect reliance persists, and supply chain transparency challenges remain acute, as hidden Chinese inputs in regional exports complicate compliance and risk management. While diversification efforts mitigate direct exposure, China’s entrenched position in critical industries underscores the long-term cost of strategic dependence.

The Role of US-Based Logistics Partners

Once cargo from China reaches US ports, speed and flexibility become critical factors. Freitty services emerges as a strategic ally for importers navigating these challenges with its key services:

- Quick cross-docking in the U.S. West Coast: Rapid transfer of containers from Long Beach/LA ports to domestic networks, slashing dwell times.

- Warehousing for overflow or longer-term storage: Scalable storage in key hubs (CA, IL, OH, NV, SC, CO) leverages dense transportation networks and proximity to manufacturing clusters, especially for seasonal demand or supply chain shocks.

- First and last mile delivery: Direct-to-consumer or retail distribution,optimized for navigating fragmented logistics ecosystems.

- Load rework and repalletizing: value-added services to meet retailers requirements.

By emphasizing speed, adaptability, and geographic precision, U.S.-based partners like Freitty can bridge gaps in a landscape where friendshoring and diversification are increasingly prioritized. This approach balances cost efficiency with resilience, countering vulnerabilities in China-dependent supply chains–Freitty ’s focus on real-time tracking and multi-modal flexibility helps importers pivot during disruptions.

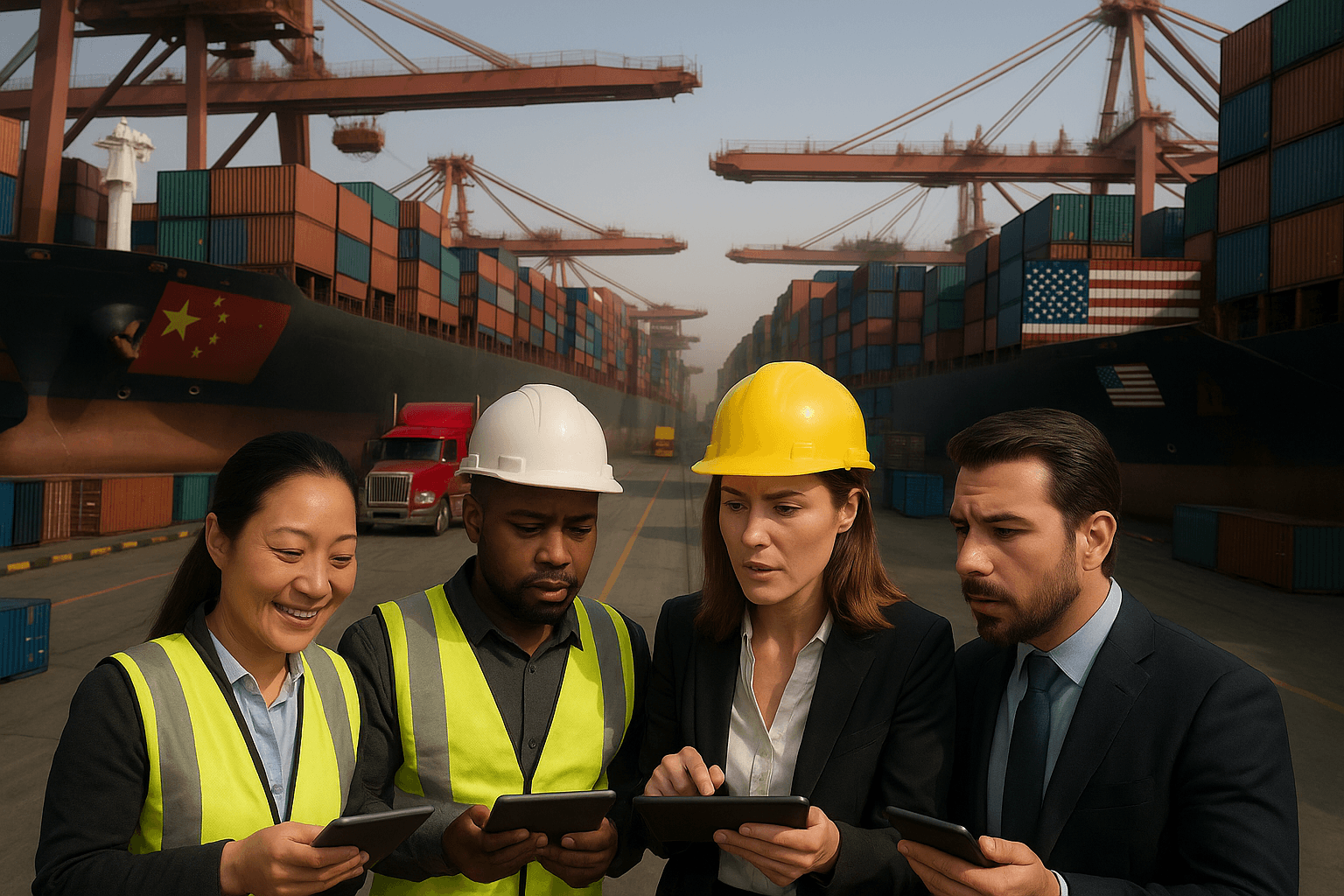

The Need for Digitalization & Visibility

The evolving US-China supply chain landscape demands robust digital infrastructure to address challenges like fragmented visibility and operational inefficiencies. Real-time tracking and forecasting have become critical for mitigating disruptions, particularly in sectors reliant on cross-border trade.

By emphasizing speed, adaptability, and geographic precision, U.S.-based partners like Freitty can bridge gaps in a landscape where friendshoring and diversification are increasingly prioritized.

Smart logistics platforms exemplify this shift, integrating blockchain for transparent documentation and automated workflows. Systems like Freitty centralize data streams from suppliers, manufacturers, and carriers, providing stakeholders with unified dashboards to track shipments and adjust strategies dynamically. Such tools reduce reliance on manual coordination, cutting delays and costs while enhancing compliance with evolving trade regulations–Freitty’s digital infrastructure ensures importers adapt to shifting tariffs or factory delays.

Looking Ahead: Trends & Strategic Moves

More companies are adopting resilient, multi-modal supply chains, combining air, rail, and sea freight to mitigate risks. Companies are prioritizing diversified sourcing strategies, with China Plus One approaches gaining traction as firms balance cost efficiency with geopolitical risk mitigation. While China retains dominance in electronics and technology sectors, businesses are increasingly supplementing operations with hubs in Vietnam, Mexico, and India to reduce overreliance.

Despite diversification efforts, companies continue to rely on China, but with smarter infrastructure in the U.S.–particularly in high-tech exports like EVs and robotics. However, U.S. firms are bolstering domestic infrastructure through reshoring initiatives and nearshoring partnerships with Mexico to counter tariff risks. This dual strategy reflects China’s persistent manufacturing advantages alongside growing US investments in advanced technologies and regional trade agreements.

Digitization is emerging as a critical enabler of supply chain resilience with the growing role of tech-enabled logistics providers in creating stability, faster delivery times and enhanced transparency. Third-party logistics providers are leveraging AI-driven automation, blockchain, and predictive analytics to optimize routes, manage tariffs, and mitigate disruptions.

Strength in Adaptation

Thus, escalating US-China tariffs and geopolitical tensions have reshaped global trade dynamics, demanding unprecedented agility from businesses, and the U.S.-China supply chain is evolving, not dissolving. However, challenges persist, and digital transformation emerges as a critical enabler–and companies that embrace flexible, digital-first logistics will not only survive but thrive amid uncertainty.

As the global landscape continues to shift, Freitty stands ready to empower this evolution, offering tailored solutions that bridge operational gaps and future-proof supply chains to ensure speed, reliability, and resilience for importers, turning disruption into opportunity.

You may also like

Bridging Giants: Navigating the US-China Supply Chain in a Shifting Global Landscape

Unlocking Opportunities Amidst Geopolitical Change

0 min read

Logistics Without Limits: How Franchising Is Fueling the Next Wave of Growth in the Industry

A New Era of Scalable, High-Performance Logistics

4 min read

Unlocking Value Together: How the Sharing Economy Is Reshaping Logistics and Beyond

The New Age of Shared Value

0 min read

Streamline Your Logistics Today

Partner with Freitty for smarter, faster, and more efficient cross-docking services.

Get started today